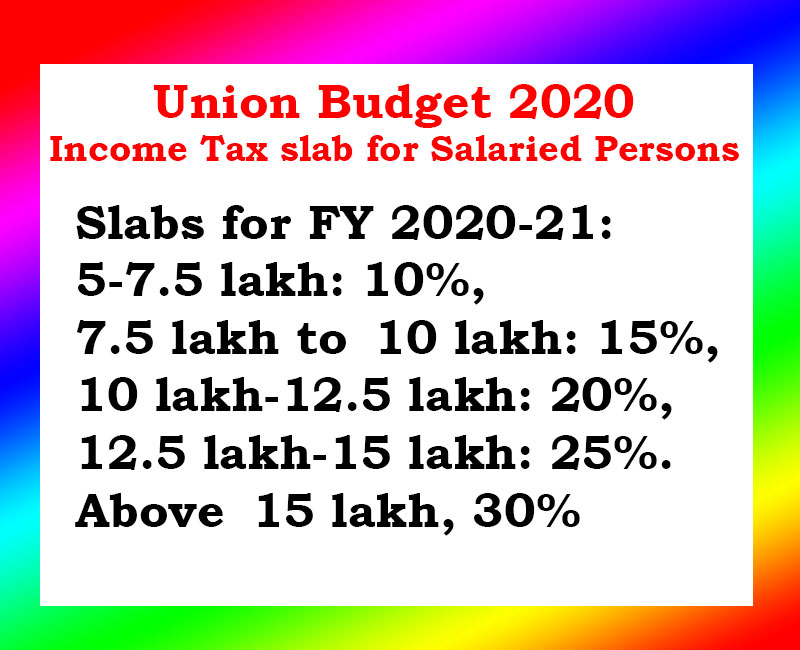

Finance Minister Nirmala Sitharaman announced tax slabs for the salaried persons for the financial year 2020-21. This budget brings relief to the salaried persons and tax sab reduces the tax for salaries persons. New tax slabs for the financial year 2020-21 will give relief to the salaried persons. As per new announcement no tax on the salary income up to Rs. 5 Lakh. Persons earning income between Rs. 5-7.5 Lakh will have to pay 10% tax. The next tax slab is for the salary between Rs. 7.5-10 Lakh which will be taxed at 15%. The income between Rs. 10-12.5lacs will tax at 20%. Finally persons earning salaries above Rs. 15 Lakh will have to pay 30% tax.

New Income tax rates:

* No tax upto Rs 5 Lakh

* 10% tax for income between Rs 5 Lakh to Rs 7.5 Lakh

* 15% tax for income between 7.5 Lakh to 10 Lakh

* 20% tax for income between 10 Lakh to 12.5 Lakh

* 25% tax for income between 12.5 Lakh to 15 Lakh

* 30% tax for income above 15 Lakh